First-Time Homebuyer Checklist

Getting a home loan is a big financial decision, especially when you’re a first-time homebuyer. There are some things you should understand in order to qualify for a home loan, from your current loans and credit cards to what area you’d like to live in. Since there is a lot to think about before you buy a house, we’ve made you a “First-Time Homebuyer’s Checklist.” This will help you be prepared when you are ready to buy your first home.

Finances

Calculate your debt-to-income (DTI) ratio

A great way to evaluate your finances is to calculate your debt-to-income (DTI) ratio, which your lender will look at when you apply for a home loan. Your debts can include any car payments, student loans, credit card debt, or other recurring monthly expenses. To figure out your DTI, your lender will divide your total monthly debts by your household’s gross income, which is income before taxes. When you multiply this number by 100, you get a percentage — your DTI. Lenders will require your DTI percentage to be at, or below, your loan program requirements. The average DTI a lender looks for is around 42%. So, the lower the percentage the better. You can calculate your own DTI using this formula to get an idea of how much mortgage you can afford. For example, let’s say that your monthly debts include a $200 student loan payment, $350 car payment, and $300 credit card payment ($850 total). Let’s also say that your gross monthly income is $3,000. That would make your DTI 28%, which is well below the desired 42%. To be even more realistic, divide your monthly debts by your household’s net income, which is your income after taxes: $850 of monthly debt divided by $2,400 of net income, gives you a DTI ratio of 35%. While this ratio is still under 42%, it shows you a more realistic picture of how much house you can afford.

Check your credit history/score

Another important factor your lender will consider is your credit report, which is summarized in your credit score . Your credit report will show your credit history and habits, including how much you owe and when you owe it. Do you pay late sometimes? Have you missed a payment altogether? Have you had to file for bankruptcy? This will all be on your credit report. A few different factors impact your credit score, some more than others. It’s broken down like this:

Payment History (35%)

Outstanding Balances/What’s owed? (30%)

Length of Credit History (15%)

Types of Credit Used (10%)

Number of Credit Inquires (10%)

Your score affects your interest rates and the type of loan you qualify for. The higher your credit score, the better. The lower your credit score, the fewer options you have. You can pull your own credit report for free from each of the three credit bureaus once a year at annualcreditreport.com. It’s important to be aware of your credit score, and work on building your credit if it’s a little low.

Save for a down payment

Depending on the type of loan you qualify for, you may need money for a down payment. This can be intimidating — don’t I have to have a lot saved for a down payment? Not for all types of loans. Don’t let a down payment deter you from buying a house. There are many loan options available, like a Conventional loan or FHA loan, which have flexible down payment requirements. A Conventional loan usually has stricter qualifying criteria, but more favorable terms. Some programs even offer no down payment options. Plus, there are programs with down payment assistance options and special terms specifically for first-time homebuyers, so talk to your mortgage banker about what loan type and down payment options are best for your financial situation.

Have funds in case of maintenance/emergencies

When you buy a house, there could always be a problem, whether it happens next week or years from now. Before you close on your home, your home inspection should catch any major problems — faulty HVAC system, leaking water heater, etc. But that doesn’t necessarily mean it will always be smooth sailing.

You should have some money saved in case your home needs maintenance or if there’s an emergency.

Let’s say your refrigerator breaks, or you need a new water heater. Maybe you have a really rough Winter and need to replace your gutters in the Spring. Do you have enough money saved to replace these items? It’s important to plan for maintenance and repairs when you’re buying a house so that you’re not blind sided down the road.

Get pre-qualified

It’s always a great idea to start the homebuying process with a lender, prior to looking at any homes. The first step most lenders will take is to ask you basic questions about your credit and income. If you’re eligible, they’ll probably issue you a pre-qualification letter, which gives you a more realistic idea of budget. Plus, real estate professionals love that you’ve already begun the financing process because it helps them know they’re showing you homes within your budget.

Preparation

Set a budget

Once you’ve been pre-qualified, determine how much you can afford based on that information and your comfort level. Establishing this before you start searching for a house will save you the heartache of falling in love with a home that’s out of your financial means.

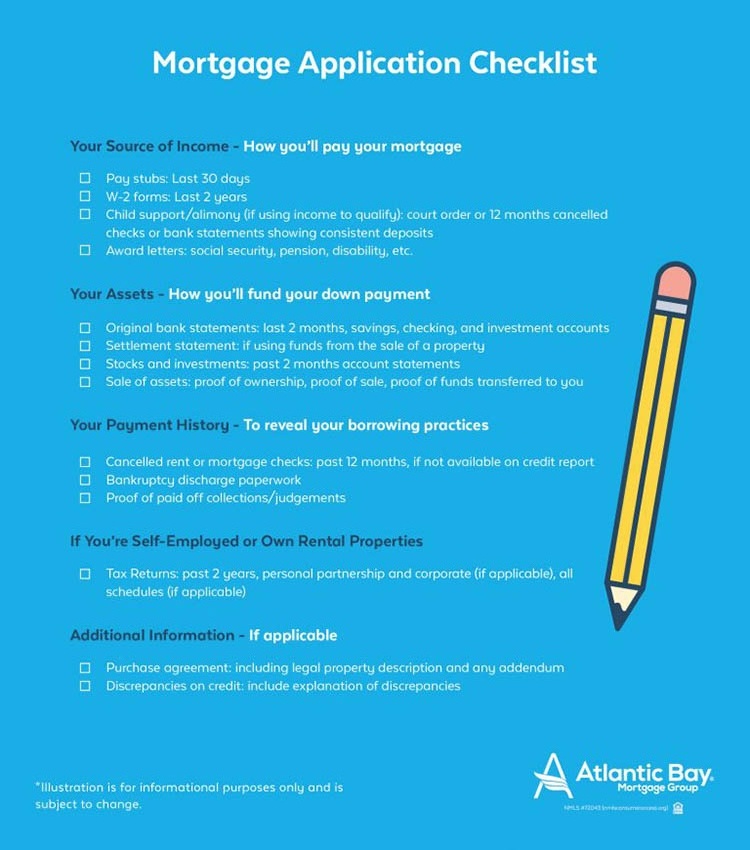

Start gathering paperwork

Besides straightening out your money and accounts, you’ll need all the paperwork that goes with it. Your mortgage lender will need documentation proving your income, assets, and payment history (among other things) and it can get a little confusing. We’ve provided this list to help you stay organized:

Create your new home wishlist

You should start making a home wish list: number of bedrooms, bathrooms, location, etc. Prioritize your list. What are your must-haves and what can you be more flexible with? Maybe you have to have 4 bedrooms, but you’re flexible on the number of bathrooms. Maybe you could compromise if the house has an open floor plan and granite countertops, but doesn’t have a screened in porch. Another important thing to consider is location. What is the school district like? Are there parks and walking trails nearby? It’s important that you know what you’re looking for when you start searching for a home. Having an idea of the home you want will also help your real estate agent narrow down the search. When you decide you’re ready to become a homeowner, start getting your finances and paperwork in order. Homeownership is an exciting life step, just be sure you’re prepared for it.